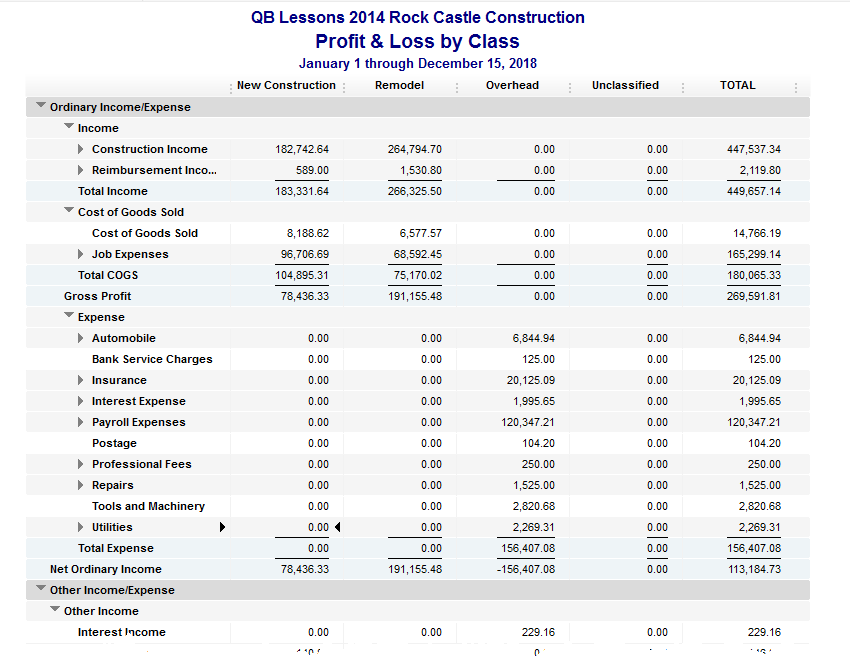

At a glance, he had no idea which revenue streams were contributing to that bulk monthly number. His month-end income statement could get no more detailed than that one account. My technology client had one big “room” for all Sales, with no bins and shelves. Accordingly, financial statements can be no more detailed or informative than the underlying chart of accounts structure. Month-end financial statements (balance sheet and income statement) simply summarize and group the balances that are in the individual accounts at month end. To illustrate, when the computer company records the sale of the Dell laptop in the above example, the accountant will go to the Revenue section of the chart of accounts and put the sale amount in the account Sales-Laptops, or perhaps Sales-Laptops-Dell Laptops if the company’s chart of accounts is more detailed. The chart of accounts is simply the organized list of all the bins and shelves. If the warehouse had no bins or racking but was simply three huge rooms-one each for desktops, laptops and printers-tracking or retrieving anything would be a nightmare.Īccounts are the specific “bins” that hold accounting transactions. That way, when a customer orders a Dell laptop, the warehouse workers can quickly and easily retrieve it. If their warehouse is well-organized, an arriving shipment of Dell laptops will be routed to a specific bin in the Dell section of the laptop area of the warehouse. Think of a computer hardware company that receives a constant stream of desktops, laptops, and printers. The chart of accounts is like the framework of shelves and storage bins in a warehouse. With such a simplistic account structure, his financials were unable to provide detail about his five distinct revenue streams. I could see the light bulbs going on as I showed him how his sales invoice lines were all configured to flow to a single sales account in his chart of accounts. “I don’t think I’ve ever looked at that,” he told me as we looked over his accounts. “Open up your chart of accounts,” I told him. Recently, I was helping a technology company owner improve his financial reporting.

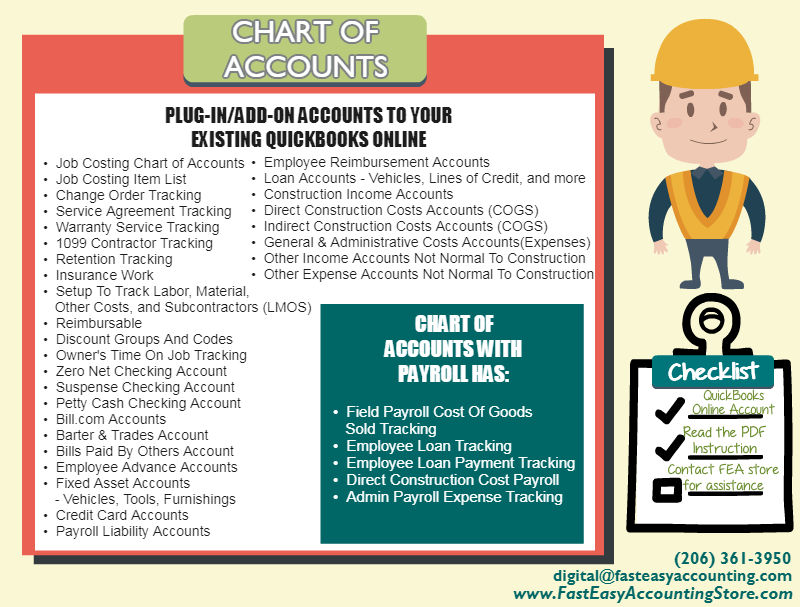

What Is a Chart of Accounts and Why Is It Important? In fact, I suggest that it is the single best and most effective way to raise the financial reporting at your organization to the next level. Thankfully, even a full-scale reboot does not require an astronomical amount of time or energy. That is equivalent to building a house on dirt instead of concrete.Ī properly executed reboot of the chart of accounts will fix both problems. Not enough thought has gone into developing the chart of accounts, which is the foundation of financial reporting.That is the equivalent of building a house for someone without asking how they want it built. Accounting teams tend to focus on doing things the “right way” rather than asking the readers of the financial statements what they want to see.It is quite common for financial reports to fall short of executive expectations. Truth is, they probably aren’t sure where to even begin. “I’ll see what I can do,” they say dryly. The discussion flows and inevitably someone says “It would be nice if we could see…” The CFO gets an exasperated expression on their face and writes the request on their notepad. These are familiar sentiments to anyone who has sat through a few financial meetings. “All this detail is great, but what I really want is a one-page report that shows our sales, gross margin, and maybe 10 categories of overhead expenses (accounting department, sales department, etc.) all in a nice neat summary.” I want to see the detail, so I know why.” When I look at the income statement, all I see is one number-travel, and it shows we’re over budget. In our budget, it’s broken out by lodging, airfare, ground transportation, etc. “I just want to see an income statement that matches our budget. “We’ve got more subscriptions than we can count right now-Slack, Office 365, Xero,, Calendly, Zoho CRM, Trello-and we’re signing up for new ones every month! Can you show me our total monthly spend on these?” Can you show me a breakdown of what goes into that number?” I know we didn’t pay that much in shop labor this month. “The labor in cost of goods sold looks crazy. Maximize the functionality of your accounting software.Consider separate accounts for key month end entries.Use accounts numbers, if you aren't already.Organize operating expenses to reflect owner preferences and match budgeting level of detail.Give careful thought to indirect costs.Build the accounts for management, not for GAAP and tax purposes.Seven steps to building the perfect chart of accounts

0 kommentar(er)

0 kommentar(er)